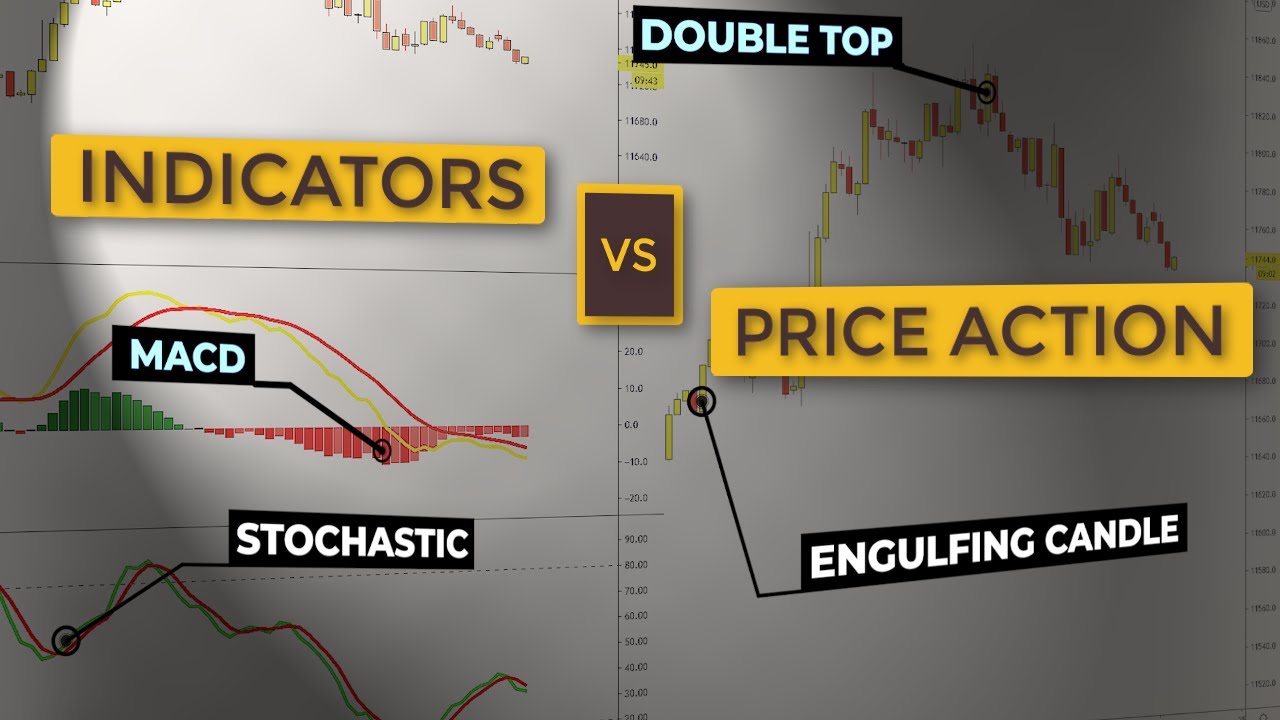

The debate between price action trading and indicator trading is ongoing among traders. Both methods have their advantages and drawbacks, and the choice ultimately depends on the trader’s preference and experience. Price action traders believe that analyzing the past and present price information on a chart while considering candlestick patterns is a better approach to predicting future market trends, while indicator traders rely solely on past market prices to make predictions. Ultimately, the success of trading depends on how a trader uses their chosen method to make informed and objective trading decisions.

Price Action Trading Vs Trading with Indicators: Debunking Common Myths

Introduction: Setting the Record Straight on Price Action and Indicator Trading

The Argument for Price Action Trading

Price Action Vs. Indicators: Similarities and Differences

Myth Busting: Debunking Common Misconceptions about Price Action and Indicator Trading

My Personal Approach: Why I Prefer Price Action Trading

Conclusion: Using the Right Tools for Successful Trading