Trading strategy with 91% win rate tested multiple times. Use Bollinger Bands Fibonacci Ratios and Pivot Point Super Trend indicators for best results. Enter at sell signal and take profit when Bollinger Bands touch lower line. Place stop loss at recent swing low. Follow for more strategies.

Testing a Trading Strategy with a 91% Win Rate

Tradingview Set Up

Indicators to Use

When it comes to trading, it’s essential to have a solid strategy that has been tested and proven to work. In this article, we’ll delve deeper into a trading strategy that has a 91% win-rate.

Step 1: Tradingview Set Up

The first step is to set up your Tradingview account, in case you haven’t already. You can find the link in the bio of the video that you watched.

Step 2: Indicators to use

The next step would be to add a few indicators on your Tradingview charts to help you execute this trading strategy effectively. Two indicators that will be helpful are the Bollinger Bands Fibonacci ratios and the Pivot Point Super Trend. Let’s go over the details of each indicator:

Bollinger Bands Fibonacci ratios:

It’s vital to use this specific Bollinger Bands indicator created by Shizuru. The Fibonacci ratios help to identify potential trends’ reversal points or significant levels. TradingView will plot these lines automatically for you, which makes it easier to analyze the market’s movements.

Pivot Point Super Trend:

The Super trend indicator uses two parameters, the ATR (Average True Range) and the multiplier, to plot a trendline that determines the market’s direction. This indicator is helpful as it helps in identifying the significant support and resistance areas in the markets, and traders often use it to identify entry and exit points.

Step 3: Implementing the Trading Strategy

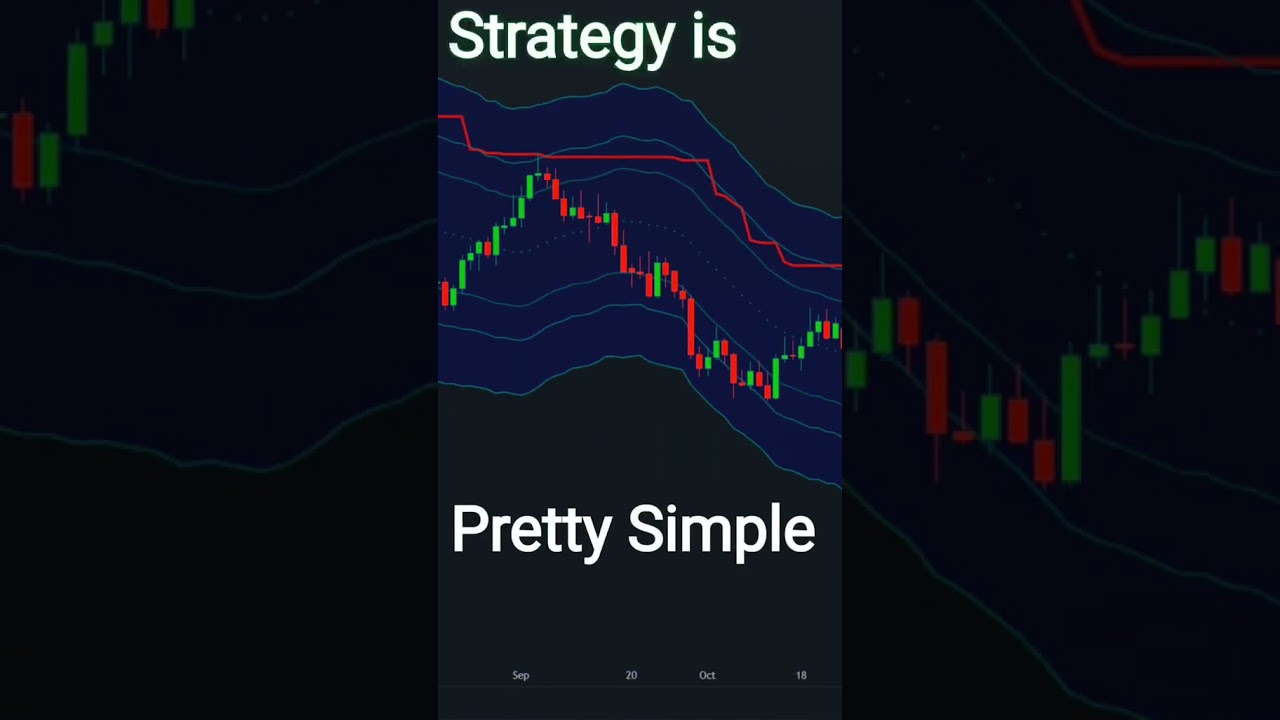

The trading strategy is relatively simple. You will get a sell signal when the price touches the super trend indicator and breaks the Bollinger Bands middle line. In this case, you would enter the trade. Once the Bollinger Bands touch the lower line and start increasing in value, you can place your take-profit order.

While implementing this strategy, you could also place your stop loss at a recent swing low. The stop loss can help you minimize losses in case the market doesn’t move as anticipated.

Step 4: Monitor the Trade and Adjust as Required

After entering the trade, it’s essential to keep an eye on the market’s movement. If you notice significant changes that could make you lose money or think of a better strategy, it’s okay to adjust the trade or exit it entirely.

Final Thoughts

Trading is a risky business, and it’s vital to have a solid strategy that helps minimize the risks potential losses. Implementing these indicators and strategy should significantly increase the probability of having profitable trades. If you want to learn more about similar strategies, be sure to follow the creator’s account for more helpful resources.