Learn all about Fibonacci retracements and how to use them to make profitable trades in this video tutorial. Identifying the trend and waiting for retracement levels are key steps, as is watching for signs of a reversal before entering a trade. Use extension levels to set profit targets, and treat retracement levels as general support and resistance areas.

Fibonacci Retracements: The Magical Tool for Trading Success

Introduction

If you’re interested in trading and want to make millions, you’ve come to the right place. In this article, we’ll reveal the secret behind the Fibonacci retracements, an essential tool for traders who want to identify high win rate trade opportunities.

What are Fibonacci Retracements?

Fibonacci retracements are levels used in technical analysis to identify potential support and resistance areas on a chart. These levels are based on the Fibonacci sequence, a mathematical sequence where each number is the sum of the two preceding numbers (0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, and so on).

When to Use Fibonacci Retracements

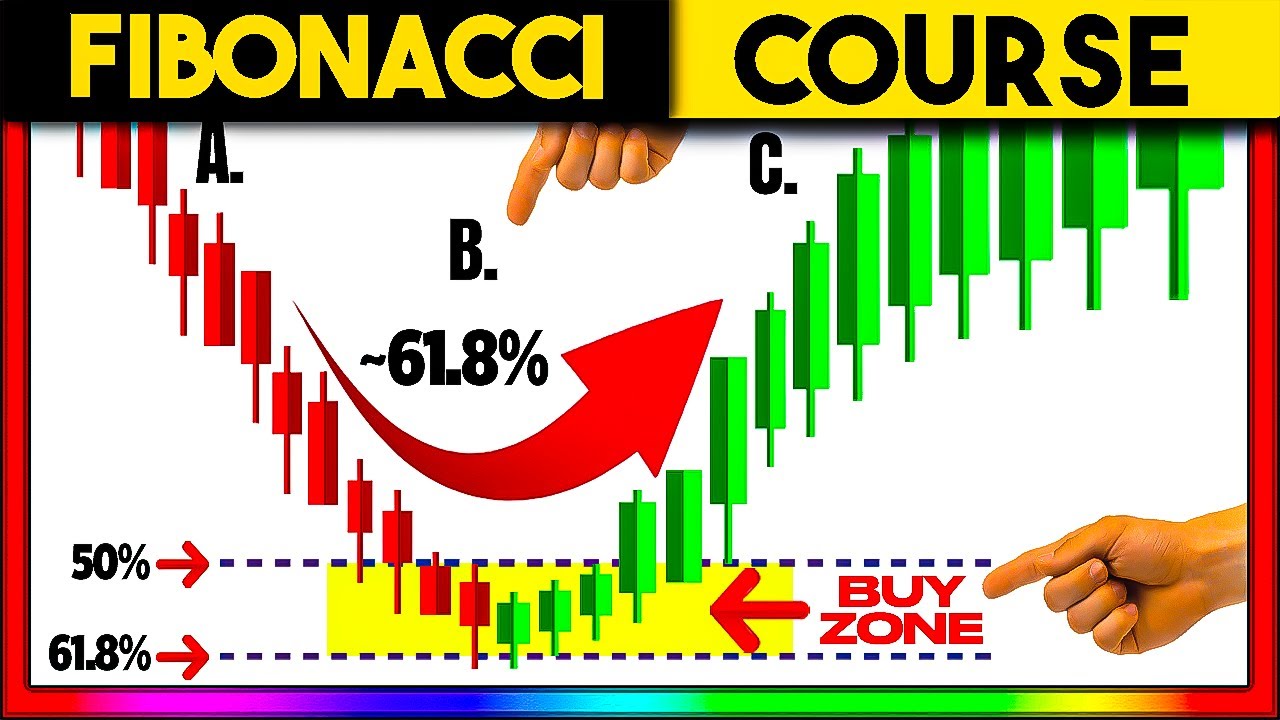

The best use of Fibonacci retracements is to identify buying or selling opportunities in an existing trend. For example, if the market is trending up, and prices have retraced to a Fibonacci level, traders may look for an opportunity to buy the asset. Conversely, if the market is trending down, and prices have retraced to a Fibonacci level, traders may look for an opportunity to sell the asset.

How to Use Fibonacci Retracements

To use Fibonacci retracements, follow these simple steps:

1. Find a clear trend in the market.

2. Apply the Fibonacci retracement tool to the chart.

3. Wait for the price to retrace to one of the retracement levels.

4. Identify signs that the retracement is complete, and price is about to hit back up.

5. Enter for a buy position and place a stop-loss below the swing low.

6. Place the take profit at the extension level.

Setting up Fibonacci Retracements

Setting up the Fibonacci retracements tool is easy, but it’s essential to copy the right settings. Traders on TradingView can click a button to apply the Fibonacci retracements, then copy the settings from an expert like our author.

Identifying Clear Trends

The first step in using Fibonacci retracements is identifying a clear trend. For example, if the asset’s price is going up, traders may anticipate buying the asset.

Applying the Fibonacci Retracements

Next, traders apply the tool to the chart, using the swing low and the swing high as reference points.

Retracement Levels

The retracement levels indicate where the price may potentially retrace. The levels are 38.2%, 50%, 61.8%, and 78.6%.

Identifying Signs that the Retracement is Complete

To identify signs that the retracement is complete and that price is about to hit back up, traders analyze candlestick patterns, such as a morning star or a bullish engulfing pattern.

Entering for a Buy Position

Once traders have identified signs that the retracement is complete, they can enter for a buy position and place a stop-loss below the swing low.

Placing the Take Profit

Traders place the take profit at the extension level, which is typically either the negative 27 or the negative 61.8 level.

Conclusion

Fibonacci retracements are an essential tool for traders who want to identify high win rate trade opportunities. By following the steps outlined in this article, traders can anticipate buying or selling opportunities in an existing trend and enter for a buy position or sell position depending on the trend. Remember to copy the right settings and identify clear trends before applying the Fibonacci retracements tool to the chart. With practice, traders can use Fibonacci retracements to make millions from trading.