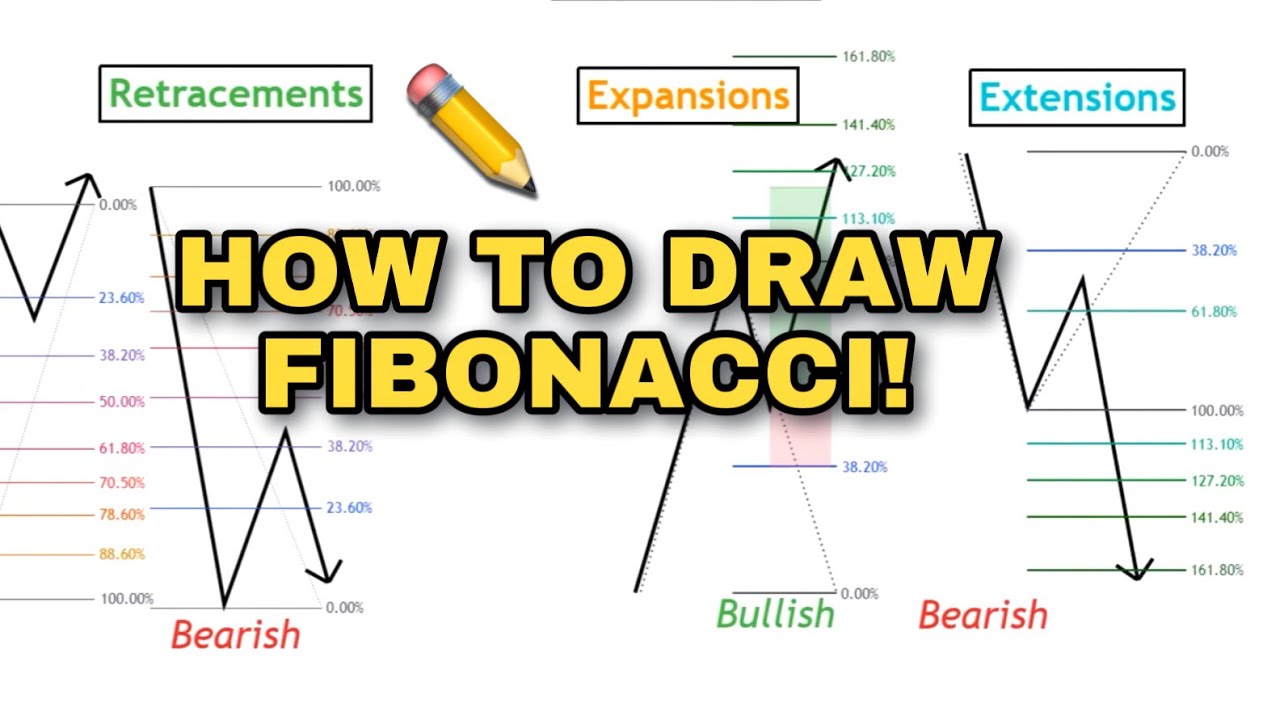

This video covers how to draw Fibonacci levels for trading, including retracements, expansions, and extensions. It is used to measure the corrective wave and potential levels for a continuation in the direction of the trend. Traders often use Fibonacci levels for entries and stop losses based on personal preferences and trading strategies.

Drawing Fibonacci for Trading: A Comprehensive Guide

Introduction

– Overview of the video content

– Importance of subscribing and liking the video

Fibonacci Retracements

– Definition of retracements and their relationship with the main trend

– Understanding bullish and bearish impulsive moves

– Determining the starting point for drawing Fibonacci retracements

– Importance of having Fibonacci levels on or off

– Strategizing entry and stop-loss points based on retracement levels

– Difference between retracements in a strong trend and retracements in a slowing trend

Measuring Bearish Impulsive Waves

– Starting points for measuring the bearish impulsive wave

– Moving the Fibonacci retracement tool to the right for better visualization

– Identifying the level of retracement and strategizing based on it

Fibonacci Expansions

– Differences between Fibonacci expansions and retracements

– Importance of having a strong belief in the trend direction before using expansions

– Starting points for measuring bullish and bearish impulsive waves

– Calculating potential Fibonacci levels for future price movements

Fibonacci Extensions

– Understanding the difference between Fibonacci extensions and expansions

– Identifying the levels for Fibonacci extensions

– Strategizing entry and stop-loss points based on extension levels

Conclusion

– Summary of the video content

– Importance of combining Fibonacci with other trading strategies

– Reminder to subscribe and like the video.