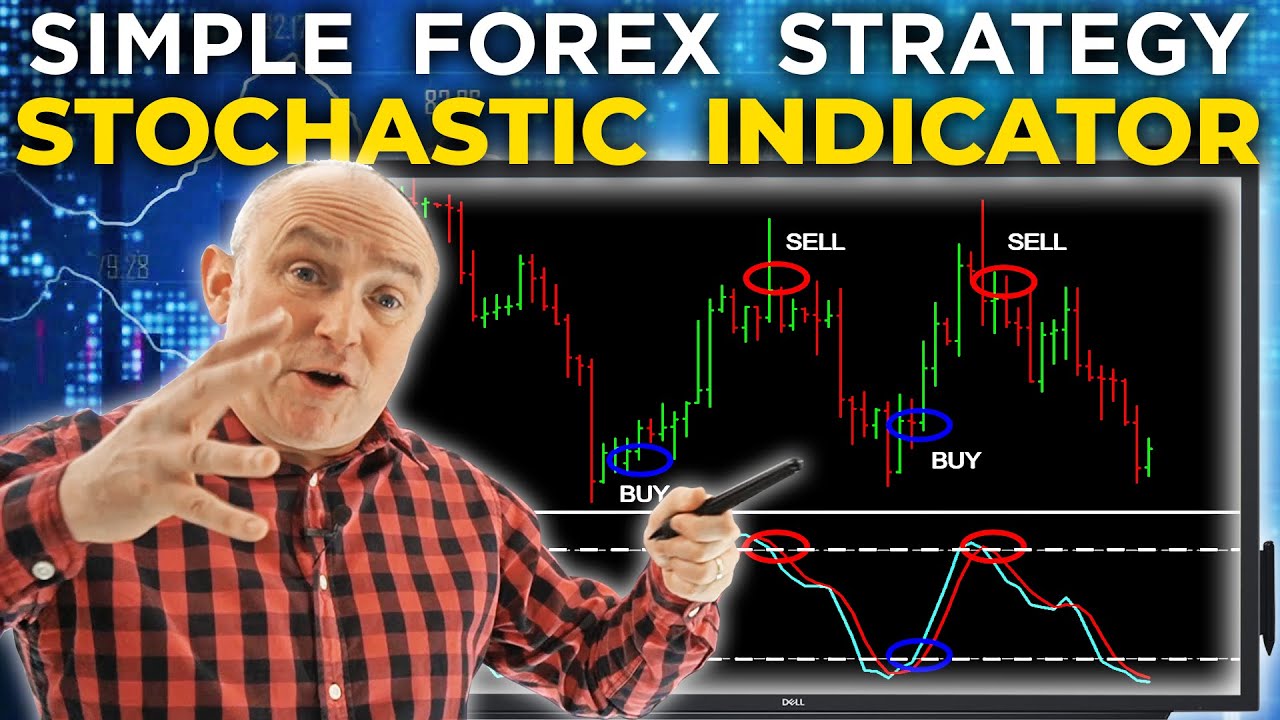

The video discusses the popular technical indicator, stochastic, used by traders. It should not be used alone but with other indicators. The indicator oscillates between 100 and 0 and has two lines: the fast line, which tracks the recent close in relation to the recent range, and the slow line, which is a moving average of the percentage k line. Traders can use stochastic to determine entries and exits of a particular strategy, including using the overbought and oversold areas for counter trender strategy.

write 1000 words and add headings article based on this youtube scriptHi there folks now today i want to talk to you about what i think is the most popular technical indicator that’s used by traders today and that’s the stochastic now the static pretty much like any technical indicator i don’t think should be used as a single standalone plug and play stochastics indicators They should be used in conjunction with other maybe technical analysis be it support resistance price action maybe other indicators as well unfortunately life isn’t as easy as just plugging in an indicator and it’s going to make you a gazillion there unfortunately that is not going to work but it’s important you understand All about this indicator and maybe you can incorporate it into your strategy development as well so what i’m going to do now is just basically explain to you exactly what the stochastic is what’s it showing us i’m going to show you the three main ways that you can use the stochastics when determining Entries and exits of a particular strategy once i’ve done this i’m going to jump on to the screens and i’ll show you real life charts as well so hopefully things will become a little bit clearer as well before i forget let me remind you this week we do have Another special treat for you you can download the cheat sheet which basically covers everything that i’m going to talk about in this presentation today basically talking about the three strategies the three ways that you can use the stochastics indicators so make sure you download that so what are stochastics basically stochastics Are oscillators oscillators basically oscillate between two different extremes you’ve got 100 and zero can’t go higher than 100 can’t go lower than a zero oscillators are typically leading indicators they give us clues to where prices may go in the future as opposed to a lagging indicator which basically looks at previous price And tells you where it’s been so oscillators are leading indicators and as i say they range up and down between between two extremes now the way we use oscillators generally is we have levels where we consider to be overbought or oversold and the overbought zone normally with a stochastic Is anything above 80 above this line here for example will become a lot clearer when we get on to the charts and anything that’s oversold will be a price action below the 20 line so below 20 is oversold below above 80 is going to be considered to be Overbought will become a lot clearer in a moment now the stochastic basically is formed with two lines i don’t want you to get too concerned about this now i did see some other educators out there going to little depths about how they’re calculating and so forth i’m not going to go too deep Into it but i think it’s important that you know exactly what the stochastic is it basically is two lines you’ve got a fast line which basically tracks the recent close in relationship to the recent range okay so it’s looking at the recent close compared to where the last uh range has Been over a predetermined amount default is i think 14 periods look back so it’s looking at the close relative to where the price has been over the last 14 periods that’s basically the fast it’s known as the percentage k line bit technical i know don’t get too bogged down by it The fast k line is the relationship of close to the recent range then you’ve got the slow line which is simply a moving average default is a three a three period moving average of the percentage k line if you understand moving averages you’ll understand that if not you can Go and check that out but basically uh the slow line is a more smoother line than the actual k line itself for the sake of this little um lesson today we’re going to color the fast line the k line with the blue and the slow line will be red as i don’t Want to go too much into the details but this is the formula that um lane came up with in the late 50s so the fast line the k line is basically the closing price minus the low in the last 14 period last um of that range Divided by the high minus the low over the same period don’t worry too much about that that’s enough as i want to say about that i’ll show you on the chart in a moment exactly um what it is showing you and it’ll make it a lot clearer and the Obviously the percentage d line is the slow line um and that’s the three period moving average of the percentage k line so they’re the formulas if you want to take a screenshot of that you can you don’t really need to know about that but let me show you on the chart exactly What it is showing okay so here is a simple bar chart and you’ve got the stochastic indicator at the bottom of the screen all indicators normally default to the bottom of the screen i’ll show you that when we get on to the charts in a moment so you’ve got the k Line that is the um the stochastic line that basically is represented in blue and you’ve got the moving average of the k line in red that’s basically how it’ll look on the chart now look here we’ve got a range of 14 bars here 14 bars looking back and the high In that 14 bar look back was around there and the low was down there but price remember on a bar chart the horizontal line to the right shows you where it closed basically prices closed pretty much at the top of that 14 bar range and that is reflected there on the k Line so you see it’s at an all-time high or recent high i should say of of that 14 bar then it rolls back let me scroll further down the chart here i’ve done another screen grab of a range here so you’ve got a 14 bar range there’s 14 bars In this range okay and if you look here price is basically in the middle of that range and if you look at the stochastic indicator the stochastic indicator signal there with that yellow little circle is in the mid-range mid-range between 100 and zero so the stochastic indicator is Corresponding to the fact that the price is in the mid of the 14 bar look back and that’s why you’ll see it there basically at around the 50 level that’s basically what the stochastic is showing you showing you the relationship to the close over the last 14 bar Look back 14 is the default uh that most um platforms use and i don’t see any real reason why you’d want to change that okay let’s say now there are a number of ways that you can use the stochastic indicator um i’m going to touch on three here the Timing of when to enter and when to exit markets and the first one i want to talk about is using the overbought and oversold areas for counter trend as you know when markets are trending don’t trend forever they do reverse at some point sometimes break out into counter trend Traders can use the sarcastic to give them early clues that the trend is about reverse or go as i say into counter so basically you can see here when the k line that’s the blue line crosses from an oversold area up through the oversold back could indicate A trend uh change in direction so it basically might mark it takes price back through the 20 line here and here we see a break higher closing up through the 20 so moving from an area of oversold into the mid-range that could indicate a buy turning point another one here Markets trend back down again you can see and the blue line the k line crosses down through the oversold so now we’re in oversold you don’t know how long it’s going to stay in…