Transform Your Trading Journey:

From Novice to Master Trader

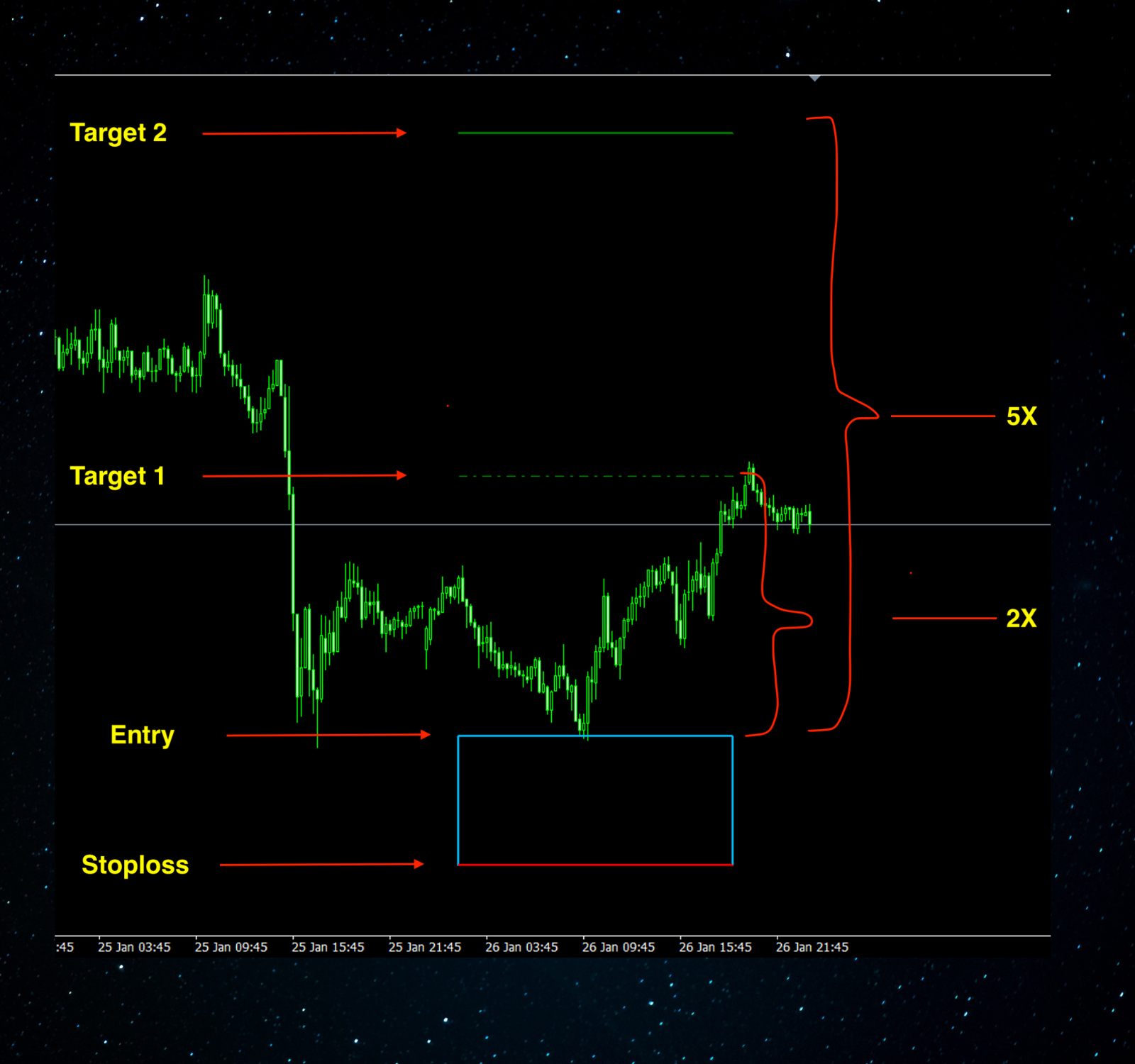

Discover the Target 5X indicator – your ultimate tool for pinpointing the optimal entry zone, ensuring day traders the potential to multiply their returns by at least 2X and up to 5X on every trade.

Our Trading Solutions

One indicator works on all instruments.

Improve your trading performance fast and easy with the leading indicator based on mathematical genius.

+10

Daily Trades

Finds enough high quality opportunities on a daily basis.

5X

RR

Excellent risk to reward ratio to keep you ahead of the game.

Use the best easy to use leading indicator that gives you 2-5R on every trade.

Learn our winning trading strategies with one on one live coaching.

Join our FREE daily signals channel, CLICK HERE

We can manage your trading account for a performance fee.

We can pass your challenge with any prop firm and also provide funded account management.

Easy to use

It is based on very solid mathematical formula, yet very easy to use.

Non Repainting

Once the trading zone and the targets have been determined they are valid for the whole day.

Tested Winner

The T5X indicator has proved itself in live trading. It can make trading easier and more profitable.

Our Clients Share Their Experience

You can find how our clients found trading with the T5X indicator.

John Miller

Investment Banker“I've been using Target 5X indicator for the past year, and it's been a game-changer for my trading strategy. The simplicity of the box, stop-loss, and target approach is refreshing, and it allows me to focus on the bigger picture without getting bogged down in complex indicators. I appreciate the clear risk-reward profile, with the first target offering a chance to secure quick profits and the second target aiming for significant gains. Overall, [Indicator Name] has helped me become a more disciplined and confident trader.”

Sarah Jones

Financial Analyst“As a busy professional, I don't have time to spend hours analyzing charts. T5X is a perfect fit for my needs - it's easy to understand and implement, but still provides valuable insights. The visual representation of the box and targets is particularly helpful, allowing me to quickly identify potential trade opportunities. I've found that [Indicator Name] has helped me improve my trading accuracy and profitability, while also saving me valuable time.”

David Lee

Day Trader“I've tried many different indicators over the years, but Target 5X stands out for its simplicity and effectiveness. The clear entry and exit signals provided by the box and stop-loss levels have helped me to avoid emotional trading decisions and stick to my trading plan. The two profit targets offer flexibility, allowing me to take profits when they become available or hold on for potentially larger gains. I highly recommend [Indicator Name] to any trader who wants a straightforward and reliable tool to improve their trading results.”

John Miller

Investment Banker“I've been using Target 5X indicator for the past year, and it's been a game-changer for my trading strategy. The simplicity of the box, stop-loss, and target approach is refreshing, and it allows me to focus on the bigger picture without getting bogged down in complex indicators. I appreciate the clear risk-reward profile, with the first target offering a chance to secure quick profits and the second target aiming for significant gains. Overall, [Indicator Name] has helped me become a more disciplined and confident trader.”

Sarah Jones

Financial Analyst“As a busy professional, I don't have time to spend hours analyzing charts. T5X is a perfect fit for my needs - it's easy to understand and implement, but still provides valuable insights. The visual representation of the box and targets is particularly helpful, allowing me to quickly identify potential trade opportunities. I've found that [Indicator Name] has helped me improve my trading accuracy and profitability, while also saving me valuable time.”

David Lee

Day Trader“I've tried many different indicators over the years, but Target 5X stands out for its simplicity and effectiveness. The clear entry and exit signals provided by the box and stop-loss levels have helped me to avoid emotional trading decisions and stick to my trading plan. The two profit targets offer flexibility, allowing me to take profits when they become available or hold on for potentially larger gains. I highly recommend [Indicator Name] to any trader who wants a straightforward and reliable tool to improve their trading results.”

John Miller

Investment Banker“I've been using Target 5X indicator for the past year, and it's been a game-changer for my trading strategy. The simplicity of the box, stop-loss, and target approach is refreshing, and it allows me to focus on the bigger picture without getting bogged down in complex indicators. I appreciate the clear risk-reward profile, with the first target offering a chance to secure quick profits and the second target aiming for significant gains. Overall, [Indicator Name] has helped me become a more disciplined and confident trader.”

Sarah Jones

Financial Analyst“As a busy professional, I don't have time to spend hours analyzing charts. T5X is a perfect fit for my needs - it's easy to understand and implement, but still provides valuable insights. The visual representation of the box and targets is particularly helpful, allowing me to quickly identify potential trade opportunities. I've found that [Indicator Name] has helped me improve my trading accuracy and profitability, while also saving me valuable time.”

David Lee

Day Trader“I've tried many different indicators over the years, but Target 5X stands out for its simplicity and effectiveness. The clear entry and exit signals provided by the box and stop-loss levels have helped me to avoid emotional trading decisions and stick to my trading plan. The two profit targets offer flexibility, allowing me to take profits when they become available or hold on for potentially larger gains. I highly recommend [Indicator Name] to any trader who wants a straightforward and reliable tool to improve their trading results.”

Frequently Asked Questions

Here are some questions our clients ask often. If you have any more questions feel free to contact us.

The Target 5X indicator gives you accurate signals as for the zone where you should start to look for a trade. If you master market bias you can expect more than 70% profitable trades with at least 2X.

The 5X target is achievable but needs a proper reason like strong news or strong trend on higher times frames.

It is a very easy to use leading indicator that you can understand how to start using it in less than 10 minutes.

This is a formula based indicator that gives leading non-repainting trading zones for the whole trading day.