The speaker discusses his frustrations with how people misuse Fibonacci retracements, and offers tips on how to use them effectively based on real price points. He also encourages viewers to subscribe to his YouTube channel to see more content.

How to Use Fibonacci Retracements Effectively in Trading

Introduction

As a trader, one of my biggest pet peeves is when people say that Fibonacci is useless. The truth is that Fibonacci retracements can be an effective tool in your trading arsenal. The problem is that many traders don’t know how to use them correctly. In this article, I will show you the right way to place Fibonacci retracements.

What is Fibonacci Retracement?

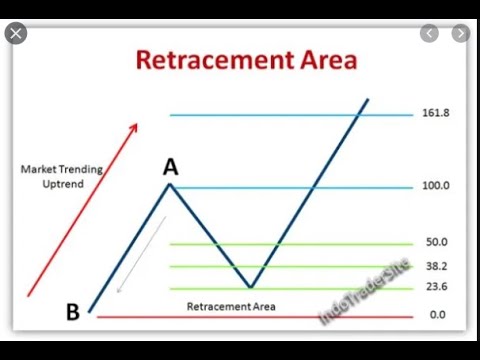

Before we dive into how to use Fibonacci retracements correctly, let’s first understand what it is. Fibonacci retracement is a technical analysis technique that involves identifying levels to which prices could retrace from their recent high or low in a trending market. The levels are based on the Fibonacci sequence, a series of numbers where each number is the sum of the two preceding numbers.

Where People Go Wrong

The reason why many people think Fibonacci is useless is that they are placing the retracements in the wrong spot. Often, traders will place Fibonacci retracements too high or too low or even in the wrong time frame for the analysis to be accurate. To place the retracements correctly, you need to be able to read price movements and understand where to place the retracements based on those movements.

The Right Way to Use Fibonacci Retracement

First things first, pick out a specific price range to work from. This range should be based on real price areas, not random numbers. Once you have your specific range, you can then place your Fibonacci retracements based on that range.

For example, let’s say that we have a specific range of 17.30 to 17.60. We would then place our retracements from the high of 17.60 to the low of 17.30. We would then double that range and place our next retracement from the high of 17.60 to the double of the range at 17.00.

Conclusion

Fibonacci retracements can be an effective tool in your trading strategy. By placing your retracements based on specific real-life price ranges, you can increase the accuracy of your analysis. Remember, trading is all about precision, and the more precise you are, the better your results will be.