A trader shares his successful gold trade strategy, emphasizing the importance of understanding the market and the risk to reward ratio in trading. Traders should continue learning, only risk what they can afford to lose, and find a balance between the RR ratio and win rate. Emotions should not dictate trading decisions.

How I Made a Profit with my Gold Trade: Analyzing Market Structures

Trading can be an exciting and profitable endeavor, but it requires a significant amount of skill, knowledge, and discipline. In this article, we’ll delve into one trader’s experience with a gold trade and examine some valuable lessons and tips to improve your trading strategy.

Starting with the Big Picture: Analyzing the Market Structure

When trading gold or any other asset, it’s essential to understand the market’s structure and direction. Therefore, it’s recommended to start on the big time frames, such as the daily or weekly chart, before moving to the smaller ones. That way, traders can see the overall trend and have a better idea of where the market is headed in the larger context.

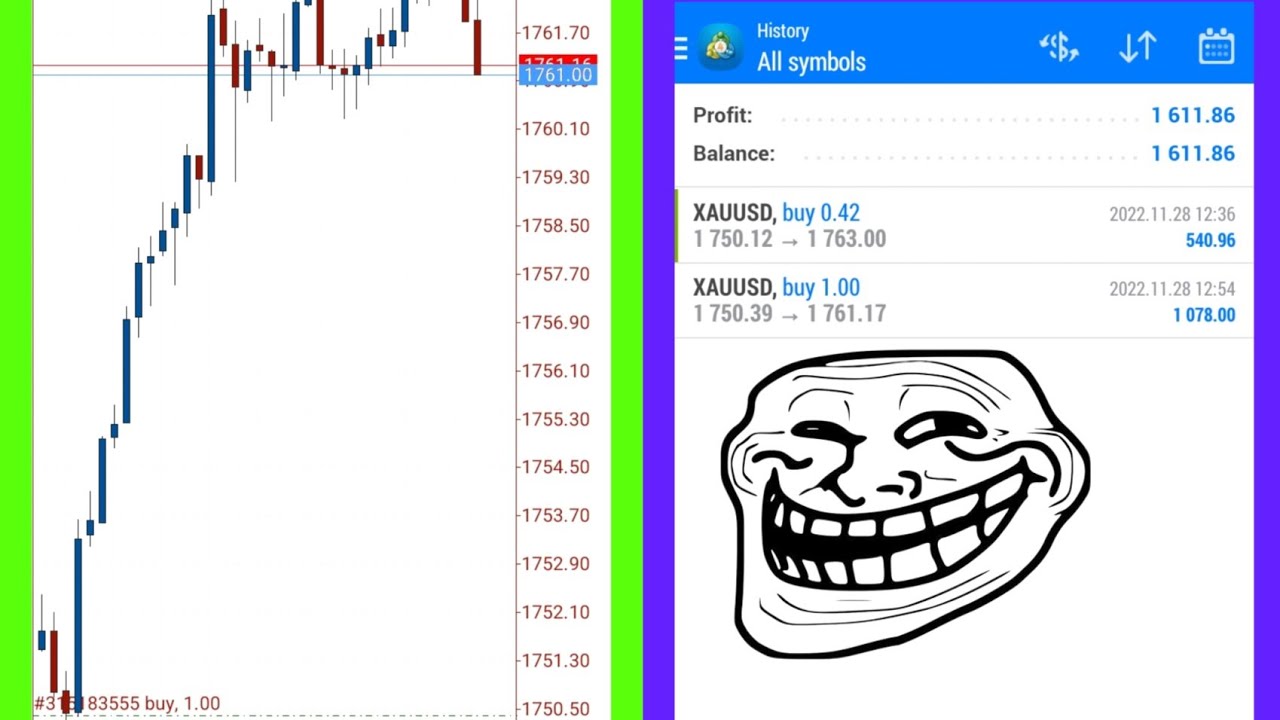

In the case of the gold trade mentioned earlier, the trader noticed a significant downtrend but realized that it was only a retest of a resistance level. Once a big wick was formed, the trader identified a potential upward trend, which signified the market’s change in direction.

Finding Confirmations for Your Trading Strategy

While identifying market structures is crucial, traders need to confirm their insights with other signals to make informed trading decisions. The trader in the gold trade story mentioned that they looked at the five and fifteen-minute charts to confirm the uptrend’s signs. Strong-looking candles were enough to assure the trader to take the trade.

However, other traders might use different indicators or confirmation signals such as moving averages, Fibonacci retracements, or chart patterns. Nonetheless, it’s crucial to select and stick to one or two confirmations based on your trading system’s criteria.

Becoming a Student of the Markets

One key aspect that sets successful traders apart is their willingness to learn and analyze the markets continually. There’s always more to learn, and market environments evolve, making it necessary to remain focused on learning every day.

To keep up to date with market news and events, traders need to do some hard research to understand the facts behind them. For instance, understanding how different economic reports affect various asset prices can help traders make better-informed trading decisions. Additionally, traders can sharpen their instincts by observing the markets’ nuances and identifying patterns that repeat themselves.

For traders to navigate markets successfully, they need to understand market intricacies and the factors that impact market movements. These include geopolitical events, world politics, weather changes, and economic trends.

Risk Management: A Key Factor to Successful Trading

Regardless of how well a trader understands the markets or how accurate their trading strategy is, there’s always some level of risk involved. Hence, traders need to manage their risks efficiently to avoid significant losses that could wipe out their trading accounts.

Risk management involves several aspects, including only using the money you can afford to lose in trading. Before putting real cash in a trading account, traders must ensure that the money is genuinely expendable, and there’s no obligation to use it elsewhere. It’s never advisable to borrow money from other pressing financial obligations such as paying mortgages or college tuition.

Another important aspect of risk management is the risk-to-reward ratio. The ratio helps traders calculate and assess their potential losses and rewards before opening trades. In general, traders must determine how much they can afford to lose in each trade and how many trades they can withstand on a given trading day.

Furthermore, traders should balance their risk-to-reward ratio with their trading win rate to achieve consistent and profitable trading results. Although it’s tempting to take risks with high reward ratios, traders must remain disciplined and avoid emotional decisions that can alter their financial goals.

Conclusion

In conclusion, trading can be an exciting journey full of learnings, risks, and rewards. Successful traders understand market structures, confirm their insights by using different indicators and continue to learn about the markets’ complexities. Additionally, traders should manage their risks efficiently and maintain a disciplined approach to trading to achieve profitable results.