Traders use indicators to identify market patterns and trends. Indicators fall into two types: leading and lagging. Leading indicators predict future market direction, while lagging indicators confirm trends already in progress. Both have advantages and drawbacks, so it’s important to understand how each works and to decide which fits with your strategy. It’s crucial to analyze yourself with how each works and decide which fits in with your strategy.

Exploring the Difference between Leading and Lagging Technical Indicators

Understanding the importance of indicators for traders and investors

Types of indicators: leading and lagging

Advantages and disadvantages of both indicators

The Difference between Leading and Lagging Technical Indicators

Leading indicators: predicting the future direction of a market

Lagging indicators: confirming trends that are already taking place

Using leading and lagging indicators together

The Pros and Cons of Lagging Indicators

Delayed feedback and confirmation of price trends

Analysis of previous price action data

Lagging indicators as a lost opportunity

The importance of using lagging indicators to validate trade decisions

A Classic Example of a Lagging Indicator: Moving Average

The role of moving averages in trading

Using the 50-period and 200-period moving averages

Bearish and bullish crossovers and their impact on trading

Why Some Momentum Oscillators are Not Leading Indicators

Common misconceptions about momentum oscillators

The difference between overbought/oversold markets and price prediction

The lagging nature of most technical indicators

Why Leading Indicators Matter

The importance of leading indicators in anticipating potential price movements

Reliance on the most common variable of price

The potential for false breakouts and minor retracements

Leading Indicator Examples

Using pivot points to determine directional movement and support/resistance levels

Fibonacci retracements and extensions as leading indicators

Volume and price as a complementary leading indicator

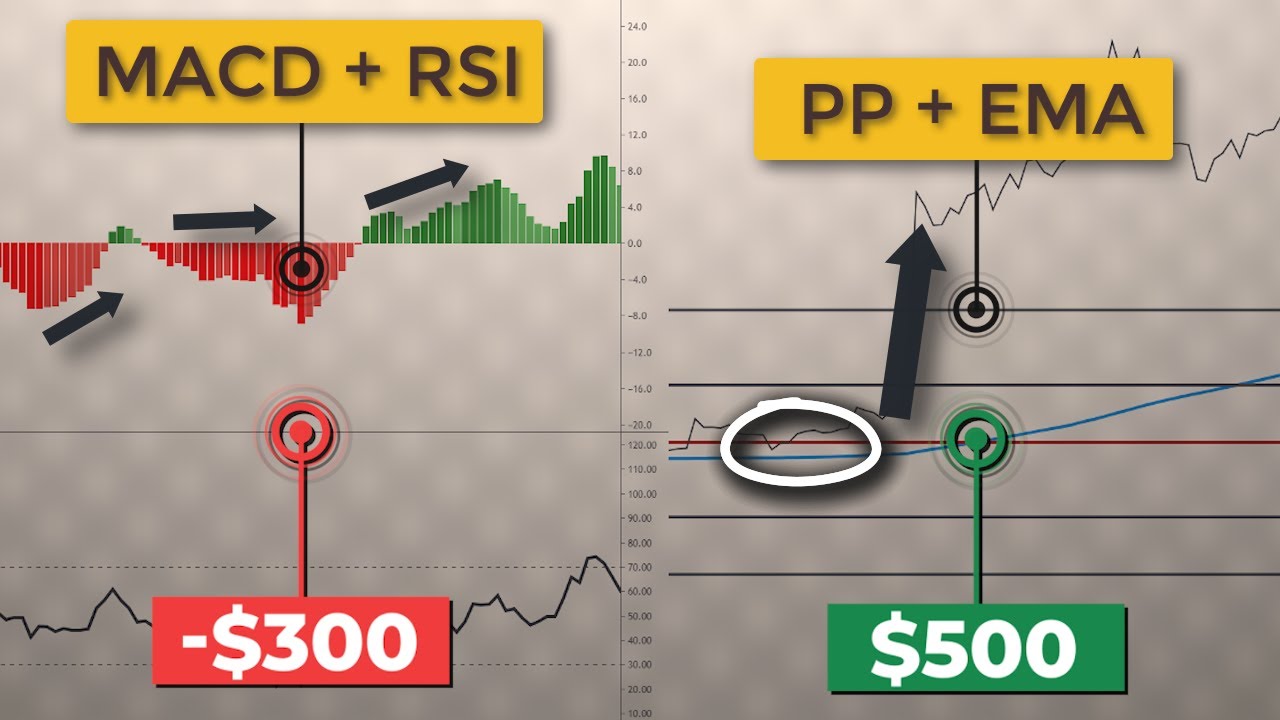

Finding the Right Balance between Leading and Lagging Indicators

The dilemma of relying solely on leading or lagging indicators

The importance of balance and accuracy in trading decisions