Learn how to use the ATR or Average True Range indicator to minimize the amount of times you get stopped out by a whipsaw in the market, why it’s important to know the average range of last 14 candles for each currency pair, and a full strategy based around the indicator to give yourself a better edge over the market. By placing a stop loss based on the volatility of the market using the ATR indicator, you can turn a losing trade into a winning trade.

How to Minimize Getting Stopped Out in Trading with ATR Indicator

Introduction

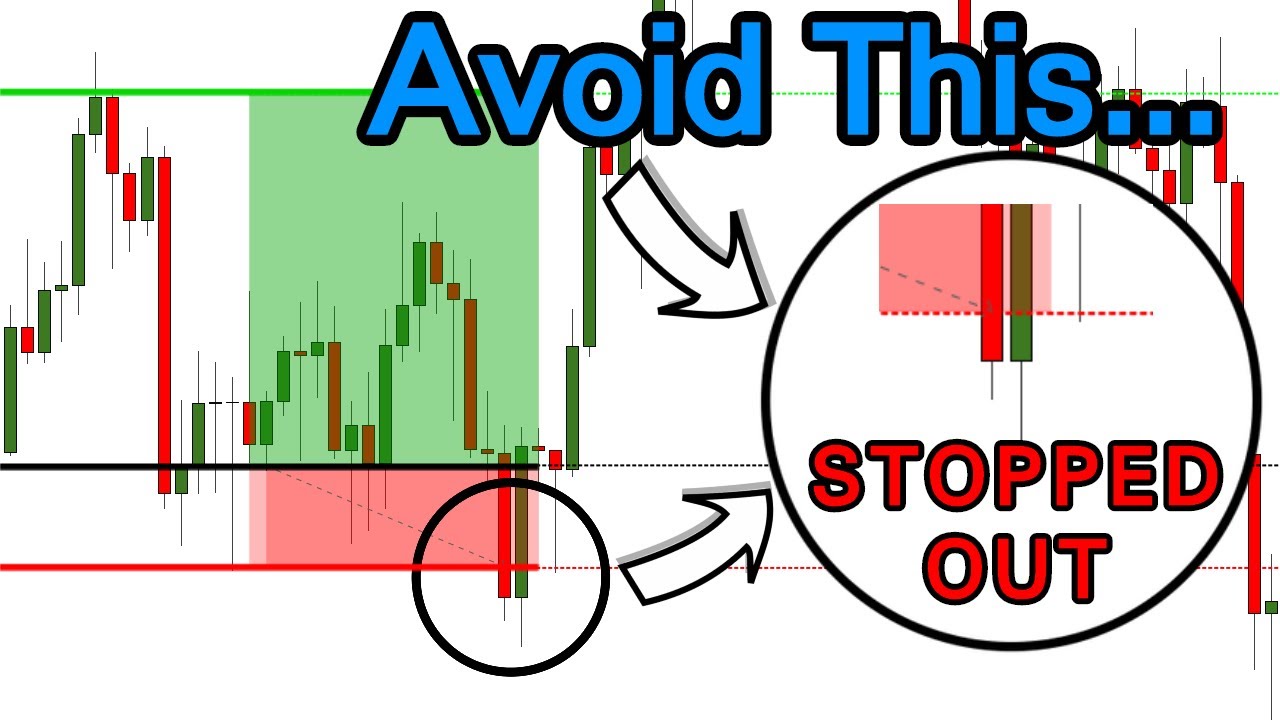

As a trader, have you ever been stopped out of a trade just to see it go in the direction you initially thought it would? This is a common problem many traders face, especially in the volatile world of forex trading. In this article, we will show you how to use the ATR (Average True Range) indicator to minimize getting stopped out in trading.

Why do You Get Stopped Out?

Before diving into the ATR indicator, let’s understand why traders get stopped out in the first place. When placing a trade, you set a stop-loss order to limit your potential losses. This means that if the market moves against your trade and hits your stop-loss level, you get stopped out of the trade.

However, sometimes the market moves against your trade temporarily, only to move back in the initial direction you thought it would. When this happens, you get stopped out, and the market moves without you. This is frustrating for traders, and it happens more often than you would like.

The solution to minimizing getting stopped out is to use the ATR indicator. Let’s understand what it is and how it works.

What is the ATR Indicator?

The ATR indicator is an averaging indicator that measures the volatility of a currency pair. It calculates the average range of price movement over a set period, typically 14 candles. The ATR indicator can be used to determine the size of stop-loss orders, which in turn helps to minimize the chances of getting stopped out.

Why Do You Need the ATR Indicator?

Each currency pair has a different average range of price movement, which is determined by various factors such as market liquidity, economic news, and global events. The ATR indicator helps you determine the average range of a currency pair, which allows you to set appropriate stop-loss levels that are not too close or too far from the entry price.

For instance, if you set a stop-loss that is too close to the entry price, you are likely to get stopped out by a whipsaw in the market. Alternatively, if you set a stop-loss that is too far from the entry price, you risk losing more money than you are comfortable with. The ATR indicator helps you strike a balance between risk and reward in your trades.

How to Use the ATR Indicator to Minimize Getting Stopped Out?

To use the ATR indicator to minimize getting stopped out, follow these steps:

Step 1: Determine the ATR Value

Determine the ATR value by looking at the top left of the chart for the currency pair you are trading. For instance, if the ATR value for the GBP/NZD pair is 122 pips, it means that the average range of the last 14 candles is 122 pips.

Step 2: Set the Stop-Loss Level

Based on the ATR value, set the stop-loss level accordingly. For example, if you are trading the CAD/CHF pair, which has an ATR value of 34 pips, you can set a stop-loss level of around 10-15 pips above the entry price to avoid getting stopped out by a whipsaw in the market.

Step 3: Set the Take Profit Level

Set the take profit level based on your risk-reward ratio, which should be at least 1:2. For example, if your stop-loss level is 15 pips above the entry price, your take profit level should be at least 30 pips below the entry price.

Step 4: Adjust the Stop-Loss Level as Needed

Adjust the stop-loss level as the market moves in your favor, using the ATR value as a guide. For instance, if the market moves in your favor by 20 pips, you can adjust your stop-loss level to break even or even move it in your favor.

Full Strategy for Trading False Breakouts with ATR Indicator

The ATR indicator can also be used as part of a full trading strategy. Here is how to use the ATR indicator to trade false breakouts:

Step 1: Determine the ATR Value

Determine the ATR value for the currency pair you are trading.

Step 2: Wait for a False Breakout

Wait for a false breakout of either support or resistance levels.

Step 3: Set the Entry Price

Set the entry price by waiting for the market to retrace back to the support or resistance level that was previously broken.

Step 4: Set the Stop-Loss Level

Set the stop-loss level based on the ATR value, ensuring that it is not too close or too far from the entry price.

Step 5: Set the Take Profit Level

Set the take profit level based on your risk-reward ratio, which should be at least 1:2.

Step 6: Adjust the Stop-Loss Level as Needed

Adjust the stop-loss level as the market moves in your favor, using the ATR value as a guide.

Conclusion

In conclusion, getting stopped out is a common problem faced by traders. However, by using the ATR indicator, traders can minimize their chances of getting stopped out by placing appropriate stop-loss levels that are not too close or too far from the entry price. Furthermore, the ATR indicator can be used as part of a full trading strategy to trade false breakouts. Incorporating the ATR indicator into your trading can give you a better edge over the market and improve your overall trading performance.