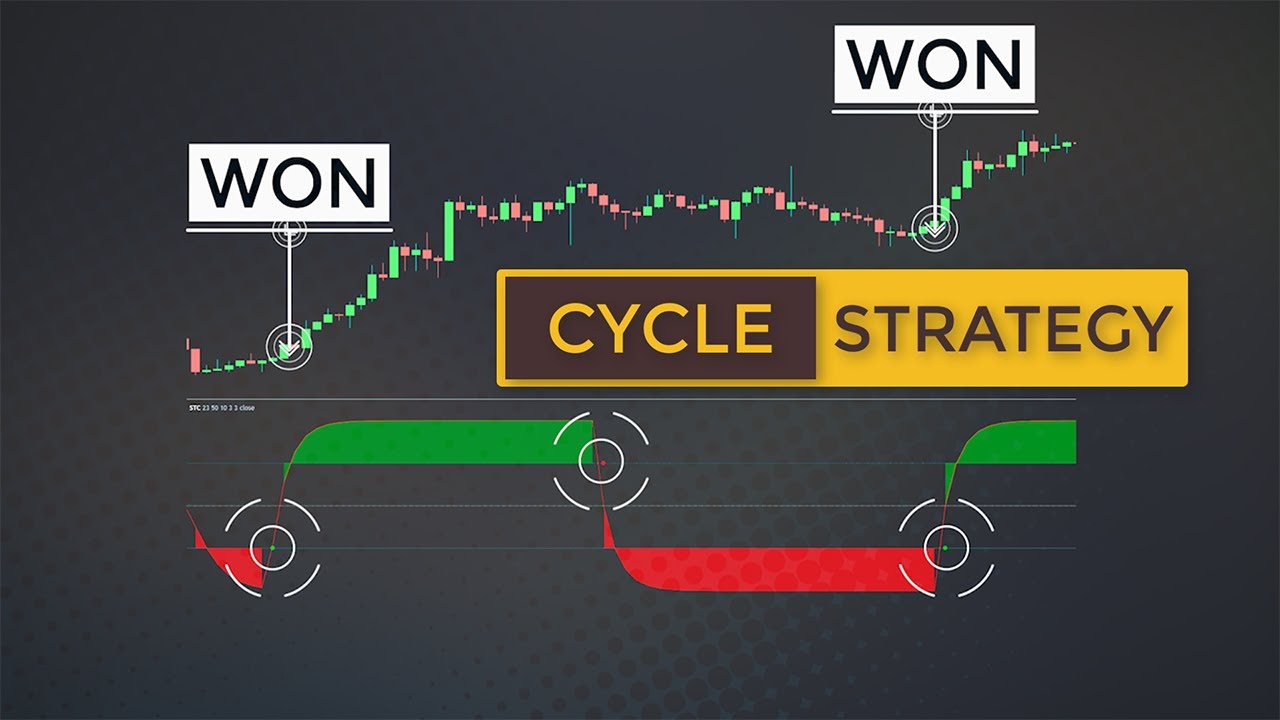

The Schaff Trend Cycle (STC) is a forward-looking indicator that combines elements of trend and cycle indicators for effective market identification. It generates buy and sell signals faster than other indicators due to its cycle component and signal line, which improves accuracy and reliability. While commonly used in the forex market, STC can be employed across all asset types and time frames. While STC can get stuck in overbought or oversold territories, it provides clear thresholds for trend identification and reversal expectation. While not accurate on its own, it can be used in conjunction with other tools to make reliable trades based on confirmations from candles and readings from other indicators.

Introduction

– What is the Schaff Trend Cycle (STC)?

– How is it different from other indicators, such as the MACD?

– Why is it commonly used by traders?

The Problems with MACD and Stochastic

– How do MACD and stochastic work?

– What are the drawbacks of these indicators?

– How does the STC improve upon them?

How the Schaff Trend Cycle Works

– What is the main idea behind the STC?

– What are the two thresholds and what do they mean?

– How can the STC be used in trading?

Using the Schaff Trend Cycle in Trading

– How can traders use the STC to identify trends and turning points?

– What are some examples of trades using the STC?

– How can the indicator’s settings be adjusted for different time frames?

Potential Problems with the Schaff Trend Cycle

– What are some potential drawbacks of the STC?

– How can these problems be addressed in trading?

Conclusion

– Why is the Schaff Trend Cycle a useful indicator for traders?

– What are some final thoughts on using the STC in trading strategies?