In this YouTube video, the presenter provides a recap of a recent gold trade, discusses other pairs, and offers insights into trading strategies.

Understanding Gold Trade and Targeting U.S. Session Highs and Lows

Introduction:

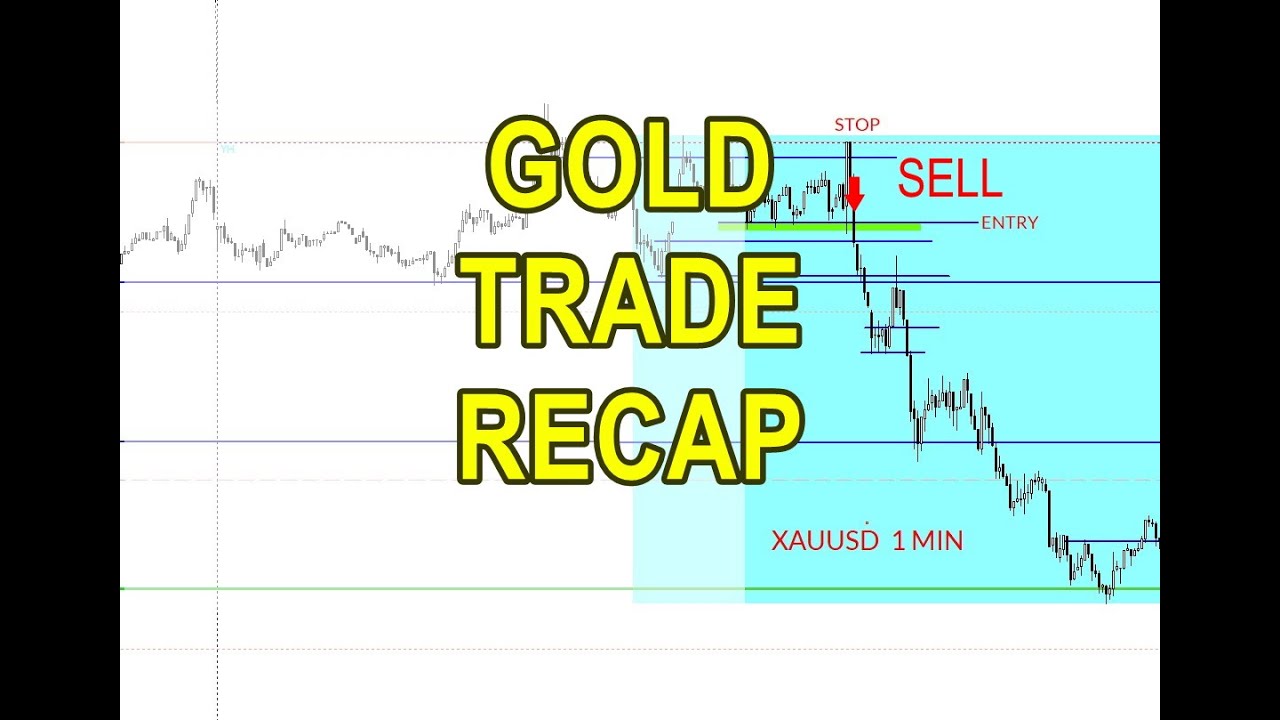

Gold trade is one of the most popular trading options for day traders. In this video, we will be discussing a short recap of the gold trade this morning, highlighting a few other pairs, and exploring the importance of understanding U.S. Session low and high, rollover time, and targeting.

Rollover Time and Targeting:

The video starts by introducing the concept of rollover time, which is the time when the day starts. Traders need to remain alert during this time. The video then emphasizes the importance of targeting the U.S. Session low and high during the Asian session. This helps traders to understand the high and low of the day, which in turn enables them to proceed and put in a peak formation high then pull it back and continue to auction higher.

Understanding Three Levels of Rise:

The video explains that when traders come below 75, there are three levels of rise. Traders need to understand these three levels to ensure effective trading.

Setting Up The Trade:

The video encourages traders to let the day set up by waiting for the first hour 30 to 45 minutes of trading. This waiting period allows traders to ensure that the market is set up correctly, providing vital information on whether to engage in a particular trade or not. During this period, traders can look at the high, space, and low of the day, allowing them to put in place previous day’s high before the pullback.

Important Elements of Trading:

Among crucial elements in trading, the video highlights developing a thesis, having a one-minute chart to track market movements, and focusing on stop loss, profit, and entry points.

Timing and Breakout Formation:

As the video progresses, it highlights the importance of timing, particularly towards the end of the hour, traders need to be vigilant as anything that breaks down underneath will be the entry point on this trade.

The video stresses that traders need to wait for the breakout that forms a “peak formation,” and anything above this level is fair game for adding positions as this provides an excellent opportunity for traders to make profits.

Targeting a 50 Pip Area:

Once traders target a 50 pip area, they need to hold on to that move. They need to ensure they have their stops and profits in place, and their trailer is locked in when the market gets down to that level. Traders need to be careful and tighten up their trailer when the market comes back.

Conclusion:

The video concludes by encouraging traders to keep it simple, lock in the whole amount or leave a trailer, close it out when it pulls back, or lock in the money and get off the screen. With these essential tips and understanding of the U.S. Session low and high, rollover time, and targeting, traders can make effective trades in the gold market during the Asian session.