Learn a gold momentum strategy that caters to busy traders who only have five minutes every hour, using a smartphone or desktop. Check the gold market, set the time frame to an hour, and use a session indicator as a helpful tool. Try to capture the intra-day momentum, which may go in either direction. Wait for the close of each candle to confirm trade signals and place a stop loss above the entry candle’s high. There is no take profit; exit when the first profitable candle closes.

The Gold Momentum Strategy for Busy Traders: A Guide

Introduction: Making the Most of Your Time

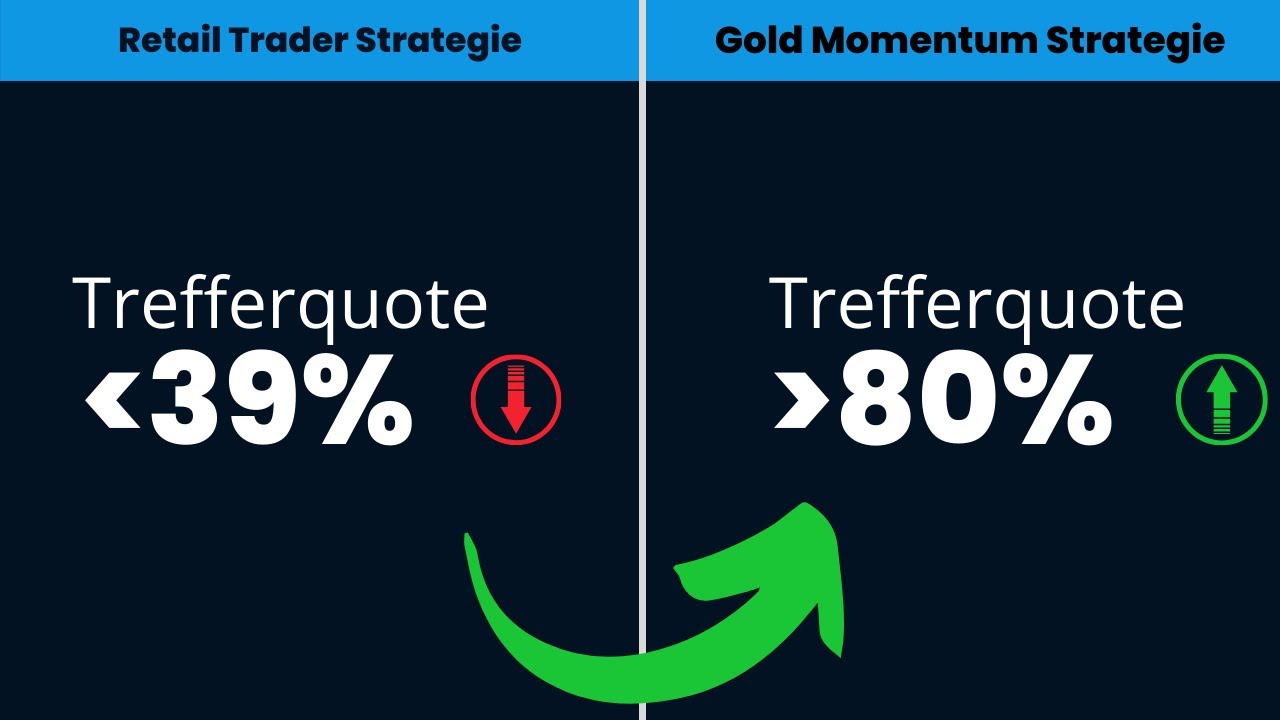

For traders who have limited time to spare, the Gold Momentum Strategy offers a swift and effective way to maximise intraday momentum trades with only a few minutes of attention required every hour. This article delves into the specifics of the strategy, outlining its steps and providing practical tips for implementation.

Step 1: Setting Up Your Platform

The first step in the Gold Momentum Strategy is to ensure that your Metatrader platform is set to Gold, and that the timeframe is set to one hour. A useful tool to have at your disposal is the session indicator, which shows the trading times of the strategy – from 8am to 5pm on any given trading day.

Step 2: Identifying Entry and Exit Signals

The next step is to identify the entry and exit signals for the strategy. When trading in either direction, it is important to focus on capturing intraday momentum. The signal occurs when the closing price of the candlestick is either lower (in case of a bearish candle) or higher (in case of a bullish candle) than the preceding period’s low.

Step 3: Placing Trades and Setting Stopp-Losses

Once you have identified a viable signal, you should place your trade with an appropriate stop-loss above the high of the entry candlestick. There is no fixed take-profit point; instead, it is dependent on the behaviour of the price action. The goal is to exit the trade when the first profitable candlestick of the hour after your entry closes.

Step 4: Evaluating Performance and Repeating Trades

So long as traders remain within the given hours for gold trading, they can use the above steps and repeat trades in either direction, depending on the signals. It is important to evaluate the trades, and to adjust stop-losses accordingly to minimise risk. Traders should use this strategy wisely and ensure it fits in with their overall trading goals with due diligence.

Conclusion: Giving Busy Traders More Control Over Their Trades

In conclusion, traders who do not have a lot of time to trade gold, especially as part of a busy lifestyle, can benefit from this simple yet effective momentum strategy. With careful attention to detail, management of trades, and regular evaluation of performance, it can provide a favourable result for the times when you can manage only a few minutes between phone calls or meetings.